Copyright © Shenzhen Esignaturechain Technology Co., Ltd. All Rights Reserved. Site Map

- 0086-400-1608685

- service@es-chain.com

- 706, Building A, Phase I, Excellence Times Square, No. 15-1 Haitian Road, Bao'an District, Shenzhen

In the finance and taxation industry, contract signing, bill circulation, tax filing and other links have extremely high requirements for compliance, timeliness and security. Traditional paper signing is not only cumbersome, but also faces pain points such as tampering risks, high storage costs, and difficulty in cross-regional collaboration.

With its core advantages of "easy to use, intelligent and safe", the electronic signature and management platform of Wudiantongyuan provides a full-link digital solution for the finance and taxation industry, fundamentally solving the industry's pain points and achieving multiple values of cost reduction, efficiency improvement and risk control.

1. Core advantages

Guarantee of safety and compliance

Financial and tax documents are directly related to corporate funds and tax risks. The electronic seal signing and management platform with the same source of physical and electronic information relies on the authoritative data source of the public security department to achieve 10-second ultra-fast identity verification. Combined with blockchain evidence storage technology, the entire signing process (including the identity of the signatory, timestamp, and document content) is solidified in real time to ensure that the evidence cannot be tampered with.

At the same time, the national secret SM2/SM4 algorithm encryption and level 3 security certification build a solid "digital defense line" for sensitive documents such as value-added tax invoices, tax payment certificates, and audit reports, avoiding the risks of forgery and tampering from the source.

Intelligent and efficient processes

The finance and taxation industry has a large number of repetitive signing scenarios (such as batch supplier contracts, employee reimbursement forms, tax agency agreements, etc.). The Wudiantongyuan electronic seal signing and management platform supports the initiation of 1,000+ signing tasks with one click, compressing the traditional inefficient process of "printing one by one - stamping - mailing" into "single instruction - automatic flow - real-time completion".

More importantly, through deep integration with ERP and financial software, the entire process of "approval - automatic contract generation - triggering signing" can be automated, avoiding manual entry errors and making the flow of financial and tax data smoother.

Flexible adaptation scenarios

In response to the complexity of financial and tax business, the Wudiantongyuan electronic seal signing and management platform provides a customized approval flow function, which can set up multi-level review based on contract amount, partner type, etc. to meet the cross-departmental and cross-regional management and control needs of group enterprises.

2. Exclusive value of the finance and taxation industry

Transforming compliance from “passive response” to “active prevention and control”

The legal effect of financial and tax documents directly affects the results of corporate tax audits. The blockchain evidence storage and public security registration certificate of the electronic seal signing and management platform of the physical and electronic homogeneous source make every contract and bill traceable and verifiable.

For example, during a tax audit, companies can quickly retrieve documented transaction contracts and invoices to prove the authenticity of the business and avoid tax risks caused by a broken chain of evidence. When faced with supplier disputes, documented reports can be used directly as court evidence to reduce the cost of defending rights.

Upgrading efficiency from "local optimization" to "full-link efficiency improvement"

For high-frequency scenarios such as signing employee expense reports, the Wudiantongyuan electronic seal signing and management platform supports "scan code to sign + automatic archiving". Employees do not need to find their leaders to sign offline, and the finance department does not need to manually organize paper documents. The process time is shortened from 2 days to 2 hours. For annual audit scenarios, the audit agency can directly retrieve financial statements and vouchers with electronic signatures through the system, reducing on-site verification time and shortening the audit cycle by 40%.

Shift costs from "hidden consumption" to "precise savings"

Under the traditional model, the cost of printing, mailing and storing a financial and tax contract is about 20 yuan, but the electronic seal signing and management platform of the same source can reduce the cost per copy to 0.01 yuan. Based on signing 10,000 contracts per year, the annual cost savings exceed 200,000 yuan.

More importantly, the smart contract comparison function can automatically identify differences in key terms such as tax rates and payment methods between old and new contracts, helping financial personnel quickly identify risks and reduce the time and error costs of manual review.

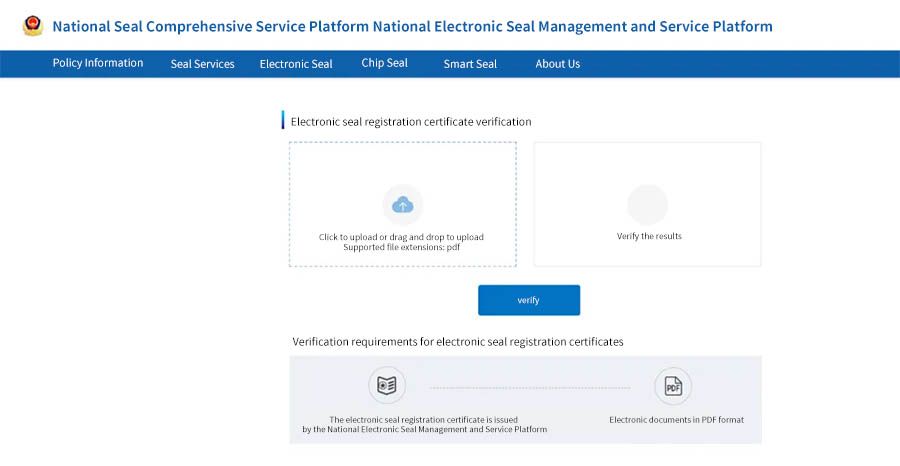

The Wudiantongyuan electronic seal signing and management platform provides trusted verification for fiscal and tax documents through a dual-authority authentication mechanism. All documents signed on the platform and the public security filing certificates issued by the platform can be verified online through the official websites of the Ministry of Public Security's Third Research Institute and the National Electronic Seal Management and Service Platform Center (Shenzhen), ensuring the security and authenticity of every signed document and filing certificate.

The electronic seal signing and management platform of the same source of physical and electronic elements ensures compliance bottom line through security technology, improves operational efficiency through intelligent processes, supports business expansion through scenario adaptation, and ultimately helps finance and taxation enterprises build a digital closed loop of finance and taxation of "signing - management - evidence storage - rights protection".

With the popularization of electronic invoices and electronic accounting files, the electronic seal signing and management platform with the same source of physical and electronic elements will become the infrastructure for the digital transformation of corporate finance and taxation. Its characteristics of "legality, compliance, efficiency, convenience, security and reliability" are driving the entire finance and taxation industry to accelerate its evolution towards intelligence and automation.

Choosing electronic signature is not only an option to reduce costs and increase efficiency, but also an inevitable move to adapt to the digital economy era and enhance core competitiveness.