Physical-Digital Integrated E-Seal Platform: Redefining Digital Signing for the Finance and Tax Industry!

Publish Time: 2025-11-17

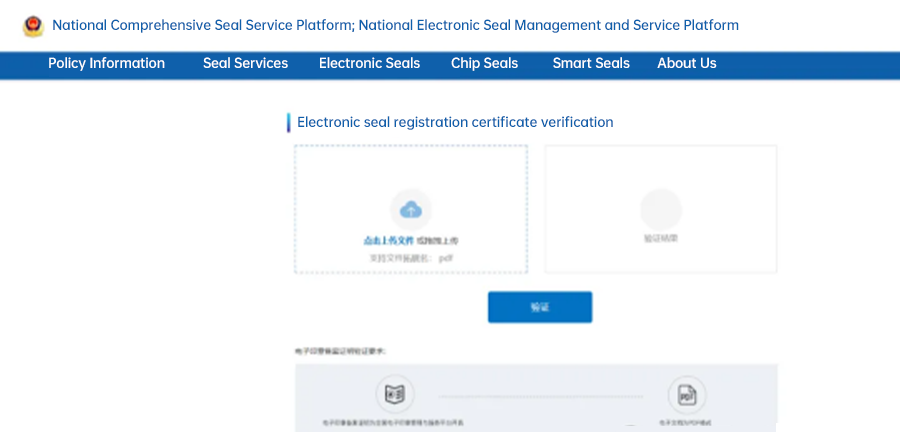

In the finance and tax sector, processes such as contract execution, document circulation, and tax filing place extremely high demands on compliance, timeliness, and security. Traditional paper-based signing is not only cumbersome but also faces challenges including tampering risks, high storage costs, and difficulties in cross-regional collaboration.Leveraging its core advantages of being "User-Friendly, Intelligent, and Secure," the Physical-Digital Integrated E-Seal Platform delivers a comprehensive digital solution for the finance and tax industry, fundamentally addressing these pain points and realizing multiple benefits: cost reduction, efficiency gains, and risk control.Core AdvantagesRobust Security and ComplianceFinancial and tax documents are directly linked to corporate capital and tax risks. The Platform utilizes authoritative public security data sources for lightning-fast identity verification within 10 seconds. Integrated blockchain-based evidence preservation technology immutably records the entire signing process – including signatory identity, timestamp, and document content – in real-time.Furthermore, national cryptographic standards (SM2/SM4 algorithms) and Level 3 Cybersecurity Classification Protection certification create a formidable "digital defense" for sensitive documents like VAT invoices, tax payment certificates, and audit reports, mitigating risks of forgery and tampering at the source.Streamlined and Intelligent WorkflowsThe finance and tax industry involves numerous repetitive signing scenarios (e.g., bulk supplier contracts, employee expense claims, tax agency agreements). The Platform supports one-click initiation of 1,000+ signing tasks, compressing the traditionally inefficient cycle of "print-stamp-mail individually" into a streamlined "single command-automatic routing-real-time completion" process.Critically, through deep integration with ERP and financial software, it enables end-to-end automation: "Upon approval - auto-generate contract - trigger signing," eliminating manual entry errors and ensuring seamless financial data flow.Flexible Scenario AdaptationAddressing the complexity of financial and tax operations, the Platform offers customizable approval workflows. Multi-level reviews can be configured based on factors like contract value and partner type, meeting the control requirements of group enterprises across departments and regions.Exclusive Value for the Finance and Tax IndustryTransforming Compliance from Reactive to ProactiveThe legal validity of financial and tax documents directly impacts corporate tax audit outcomes. The Platform's blockchain evidence preservation and public security filing certificates ensure every contract and invoice is traceable and verifiable.For instance, during tax audits, companies can swiftly retrieve certified transaction contracts and invoices to substantiate business authenticity, avoiding tax risks associated with broken evidence chains. In supplier disputes, the preservation report serves directly as court evidence, reducing litigation costs.Elevating Efficiency from Localized to End-to-EndFor high-frequency scenarios like employee expense claim signing, the Platform supports "scan-to-sign + auto-archiving." Employees bypass the need for physical signatures, and finance departments eliminate manual document sorting, slashing process time from 2 days to 2 hours. For annual audits, firms can directly access e-signed financial statements and vouchers via the system, reducing on-site verification time and shortening audit cycles by up to 40%.Shifting Costs from Hidden Drain to Precise SavingsTraditionally, printing, postage, and storage for a single financial/tax contract cost approximately ¥20. The Platform reduces this cost to as low as ¥0.01 per document. Based on 10,000 contracts annually, this translates to over ¥200,000 in yearly savings.Moreover, the intelligent contract comparison feature automatically identifies differences in key clauses (e.g., tax rates, payment terms) between contract versions, enabling finance staff to rapidly pinpoint risks and reducing the time and error costs of manual review.The Platform provides trusted verification for financial and tax documents through a dual authoritative authentication mechanism. All documents signed via the Platform, along with the Platform-issued public security filing certificates, can be verified online through the official websites of both the Third Research Institute of the Ministry of Public Security and the (Shenzhen) Sub-center of the National Electronic Seal Management and Service Platform, guaranteeing the security and authenticity of every signed document and filing certificate.The Platform safeguards compliance through robust security technology, enhances operational efficiency via intelligent workflows, and supports business expansion through flexible scenario adaptation, ultimately helping financial and tax enterprises build a digital closed loop encompassing "Signing - Management - Preservation - Rights Protection."With the growing adoption of electronic invoices and e-accounting archives, the Physical-Digital Integrated E-Seal Platform is becoming essential infrastructure for corporate digital transformation in finance and tax. Its characteristics of being "Legally Compliant, Highly Efficient & Convenient, and Secure & Reliable" are propelling the entire industry toward an accelerated intelligent and automated evolution.Adopting e-signatures is not merely a choice for cost reduction and efficiency gains; it is an imperative for thriving in the digital economy and enhancing core competitiveness.